Budgets, Deficits, & Debt 101 - Pathway to Destruction!

- Beach Bum Philosopher

- Oct 18, 2013

- 8 min read

Budget, Deficits, and Debt – Where Do You Stand?

To me the most critical danger to our great country is the growing budget, running annual deficits, and ever increasing national debt. Before I give you my rationale for why I consider this the most critical problem we face, I would like to define the three terms: Budget, Deficit, and Debt.

What is a budget? It is not so different than what you do at home by deciding how much money you are going to spend on the various items and bills you have for that year. Likewise, the government creates an annual budget. The President crafts his desires of how much he would like to spend on various items: Defense Spending, Welfare, Interest on the debt, Healthcare… That Presidential budget then goes to congress to consider his request. Rarely does the congress agree with the President’s desires since he tends to ask for more money than currently is needed. The House of Representatives, according to the constitution, has the powers of appropriations or ability to fund the budgetary items. The House creates and funds the budget by passing what are termed appropriation bills. Once the appropriation bills are passed the Senate can choose to pass those house bills or revise them accordingly and pass the revised version in the Senate. If the House and the Senate versions are different the two sides meet in a conference committee to hash out the differences. In the end, the final version is then passed by both House and Senate and signed into law via the President. This sets the spending for that year and multiple years if passed in that fashion.

What is the annual Budget Deficit? The easiest way to think about the deficit is that it is the amount of money you overspent compared to your budget and money you earned for that year. For example, if you budgeted $100,000 to spend for the year based on mortgages, utility bills, gas… and at the end of that year you only spent $90,000 then you would have an annual budget surplus of $10,000 since you did not spend the full amount you budgeted. Likewise, if you spent $130,000 you would have an annual budget deficit of $30,000 since you spent more than you planned in your budget. This holds true for the government in that if they spend more than what they brought in from taxes... for the year they run an annual budget deficit.

What is the Debt? The sum total of all the yearly deficits minus any yearly surpluses is the total debt you owe. So this is the amount of money the government had to borrow due to spending more than their annual budget/revenue and adding all the deficits together minus any surpluses gives you the total debt.

So why does it matter if we have yearly deficits and our total debt keeps growing? Why do I consider this the most critical issue facing our country? To answer this I will stick to our average Joe home scenario. If Mr. Joe wants to spend more than what he makes he has to borrow the money from someone to do that. Mr. Joe usually borrows the money from a bank or credit card. But borrowing requires you have to pay interest on that money you borrow. So say Mr. Joe borrows $50,000 and makes payments on that to pay it off. In the end, depending on the interest rate he is paying, he will pay more than $50,000 back since he also paid interest on that loan. If you look at your home mortgage loan you will see that you pay a lot of money in interest by time you pay off the entire loan. So the more he borrows the more interest he will have to pay back. More of his paycheck will go towards paying the loan and interest than to pay his utility bills, gas… The same holds true for the government. How they borrow money is to sell Treasury bills, bonds, … to people to generate the cash needed. But they have to pay those people back with interest. So the more money the government borrows the more money it has to dedicate to paying interest and bonds that come due rather than to the programs it originally funded via the budget. This leads to some hard choices. Either the government has to raise taxes to bring more money in or it has to cut spending by decreasing how much it will spend on certain programs. Ultimately, if the government keeps borrowing it will not be able to sustain itself and in the end the citizens will suffer through paying the government more and receiving fewer services.

In addition, as the government gets to a point where it looks like it is going to have trouble paying off its debt and interest to borrow money they have to increase the % interest it will pay the people that buy the bonds. This leads to higher interest rates to average Joes when they go to get a car loan or home loan. This leads to higher interest rates for businesses that need to borrow money. This additional cost to you and the businesses hurts you. The businesses will more likely pass on some of this cost to its customers since it has to still make a profit to survive. So the net result is that average Joe ends up paying more taxes to the government, higher interest rates for his loans, and higher cost for the products he buys from businesses.

The only recourse for Mr. Joe is then to either get another job to increase his pay or decrease his spending. When he decreases his spending, businesses make less money and less taxes go to the government. In addition, businesses may cut jobs in order to cut cost which impacts many average Joes. So you can see you get into a death spiral the longer you keep growing the government and borrowing money.

Ultimately, the government will have to stop spending and if they end up cutting so much it puts the nation at risk due to not adequately being ready to defend the country or be able to respond to natural disaster relief from Hurricanes, Tornados, … It cannot sustain the programs that give free this or free that.

What is our Current Path and How do We Correct It?

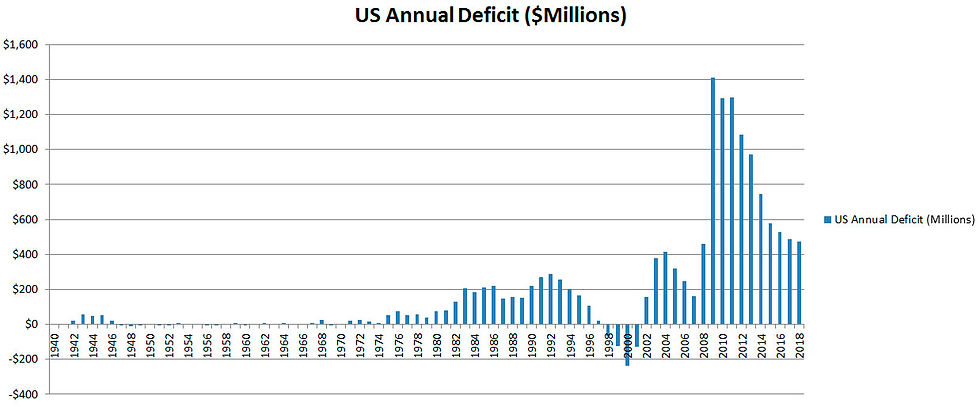

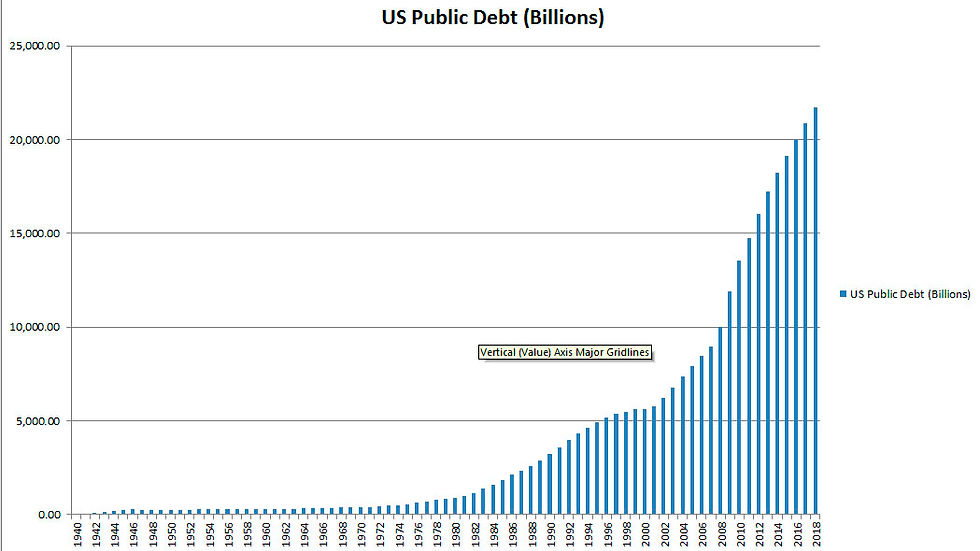

I have put together two charts that to me show you all you need to know. Our deficits are way too high and our total debt is out of control.

Data Source: USGovernmentSpending.Com

If you look at the chart there were a few points in time where deficit spending became acceptable. The spending seemed to really take off starting with Reagan through Clinton's first term. Then in Clinton’s 2nd term we again found fiscal responsibility which led to a budget surplus. It wasn't long before we went back to our overspending ways with GW Bush. Obama has taken it to record levels never seen in this country. There are many reasons for the deficits which I will not cover here, but it is obvious to me that we are on a path to destruction. You may hear our current President state that the deficit is coming down faster than in the last 50 years. This may be true in terms of math, but he is still running higher deficits than any other President in history. I don’t think overspending by $900+ billion dollars this year is something to be proud of, do you? You can see in the next chart how all this spending has created the massive debt we have today.

Data Source: USGovernmentSpending.Com

Our national debt has recently hit the $17+ Trillion dollar mark. We spend about $30 Million a month just to pay interest on this debt. At the trajectory we are on the Congressional Budget Office and many others have stated we are header for destruction. This is just one of the reasons lately the USA has had its credit rating lowered. When you show no signs of correcting the problem the outside agencies will react.

Let me put it into perspective for you. Below I have put what each citizen of the USA would have to give the Federal government in order to pay of the debt at that point in time.To pay off the debt in 2011 each citizen would have to give the government $45,782. Compare that to:

1938 = $286

1950 = $1,697

1990 = $12,924

2000 = $20,091

2012 = $52,152

I don’t know about you but I don’t have $53,000 just laying around to give to the government. For the first time in history each person owes more than what an average person makes in a year. Do you honestly think this is the way to go?

So how do you solve this? The first thing is that we must demand our President and Congress stop the insanity. If they won't you need to elect officials that will analyze the situation and solve the problems now. They cannot keep increasing the debt ceiling and spending. The time is now to act and act decisively. The government needs to do two things.

Decrease spending

Increase the amount of money coming into the government

What would I do if I were in charge to accomplish the two above?

1. Scrap the 70,000+ pages of the tax code and convert to a flat tax system. Based on my rudimentary calculations this system would bring in ~$3 Trillion + which is more than what we need currently

a. 18% flat tax for individuals – no deductions and HSA deposits are tax free

22% flat tax for corporations (on-shore) money – no deductions other than funding employee HSA is tax free

30% flat tax for corporations (off-shore) money – no deductions

To increase taxes it would take a 2/3 vote in both houses to be approved

Any budget surplus – 50% would go to pay off the debt and 50% refunded back to the tax payers. Once the debt is paid off, 50% goes into a rainy day fund and 50% refunded back to the tax payers

2. Pass a balanced budget amendment as seen in Mark Lavine’s Liberty Amendments

3. Prioritize our funding based on constitutional principles

a. Defense of the Country

Infrastructure/interstate commerce

Economic Development

Energy

4. Reform healthcare as seen in a previous post of mine (Real Healthcare Reform (wixsite.com))

5. Reform Social Security so that each individual would have a 401ss where their Social Security payroll taxes would be deposited. They could manage it like their current 401k accounts. The Federal government could have oversight of what options are available for the person to invest to insure adequate high quality products are available. The money could not be touched until you reach age 65 which is slightly different than 401k of today. This eliminates the ability of the government to borrow this money and puts the individual in control of the funds. It truly takes this off budget. Naturally for those 35 or older they would stay on the current Social Security system where anybody below that would convert to this new individual control system.

6. Drastically cut or eliminate all subsidies and foreign aid

7. Adopt all of the above energy policy

I believe if you adopted this 7 point plan it would stimulate our economy to grow. By growing the economy and getting people back to work you also increase money coming into the government since more people are earning money to pay taxes. In addition, you have a fair tax system which everyone is paying the same percentage. The high income individuals will be paying more in terms of real dollars since they earn more money. In addition, you are reducing spending and prioritizing what the Federal government should be involved in for the greater good of the States and country. Finally, you are creating a system that encourages companies to invest in America and their employees instead of other parts of the world. You are restoring the faith in this country to meets its obligations and providing freedom to each citizen to grow to their potential and live a life of happiness and not fear.

So until next time, Make Each Day Count!

Beach Bum Philosopher

Comments