Real Healthcare Reform

- Beach Bum Philosopher

- Oct 16, 2013

- 9 min read

Now that we entered the days of government regulated and controlled health care with the Affordable Care Act (Obama Care), you have seen the "unintended" consequences. Some of those are as follows: A shift from full time to part time work, elimination of employer subsidized insurance, job growth stagnation, cuts in Medicare funding and reimbursements, increase Medicaid enrollment, and a rise in premiums.

In my personal opinion, these consequences were not unintentional due to the fact that many progressives want a single payer, socialistic health care system. Since the American public rejects this method of health care, the way to go about swaying the opinion polls is to create a crisis and blame those problems on the insurance companies. So as the ACA proceeds, I predict you will see two groups of people. Those that love it because it gives them something for very little cost due to the subsidies provided by the government which are paid for through higher premiums and taxes within the ACA. The other group, which will be the majority, will be those that come to disapprove of it due to the rise in premiums, higher deductibles, and/or additional penalties and taxes. So if the premiums become too burdensome on the majority, the progressives will use that to make an argument that the government should provide a single payer system and get the greedy insurance companies out of the business of hurting people.

Historical Data

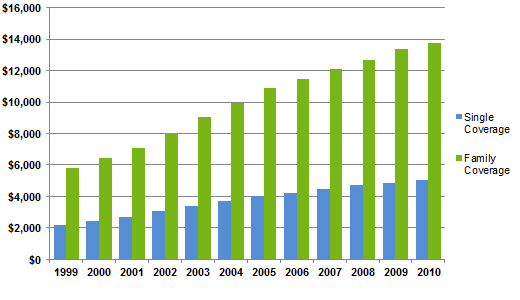

If you look at the premiums from 1999 to 2010 you will see that on average they have increased 7.8% annually which is far greater than inflation and pay increases. There are many reasons for rising health insurance costs which is out of the scope for this opinion piece, but I agree that we definitely need to reform the system to drive health care cost down which in turn will drive insurance cost down.

So the argument of needing a change I believe to be a valid one. I don't agree with how the ACA went about it and will try to demonstrate it in this piece. Another interesting piece of information is the projected health care spending even with the ACA implemented.

As you can see, the spending will continue to rise and be one of the top budgetary items for the Federal budget. So based on these two pieces of information, the average American will not be able to afford health care in the future. This is based on increased premiums/deductibles and the government not being able to support Medicare, Medicaid, and other government health care models.

One last chart to demonstrate the need for a change is the fact that the US spends far more than the world when it comes to health care. So what is the good and bad of the ACA? What are some real reforms that we must do to correct this trend?

ACA - Good and Bad

The Good

No annual or lifetime limits

Coverage for preexisting conditions

Evidence based care

Insurance policy spending limit on non-clinical care (80/20) rule

Why do I feel these are good measures? When the unexpected happens there is no reason a person should go bankrupt because the insurance policy he/she purchased has a limit. How do you set a limit on a person's life? Also, for those individuals that lose their job and employer provided insurance and have a pre-existing condition, they should not be uninsurable. Where I differ from the ACA, pre-existing condition patients should have to pay a higher premium. This is similar to the high risk auto insurance industry. Finally, the focus of the health care you receive through your insurance should be based on evidence based protocols/quality care. The vast majority of the policy's expenditures should be spent towards that. This will insure that the patient is receiving the most appropriate care at the time of service.

The Bad

Individual mandate, penalties, taxes, and government centric policies

Does nothing to decrease health care spending and cost which will only add to the debt

Decrease in quality of care over time (see below)

Limits choice of coverage (ie. Maternity coverage on all plans even if you are a man)

Encourages employers to decrease employees to part time status and drop their health insurance plans

Exemptions to the law which sets up a class system (ie. Congressional employees get Federal subsidies to pay for insurance policy ~72%)

Premium increases due to added coverage, pre-existing conditions, and no caps

IRS enforcement of ACA

Though you still have insurance companies providing the policies the Federal government has total regulatory oversight and deciding on value added services (aka Death Panels)

Spending $130B a year for 10 years by CBO estimates and still will have sizable uninsured population

Many other features which are to numerous for this article

Why do I think the quality of our care is in harms way under this law? Let us look at past plans and Medicare as examples. Anytime a health insurance policy or Medicare needs more money they will either increase revenue with higher premiums and/or taxes or find a way to reduce cost. One way to cut cost is to remove a service provided or limit the reimbursement of that service so less money is sent out to the provider. This ultimately leads to the patients being dropped by their practitioner since the provider does not make enough money than care provided. You see this especially with government run plans like Medicaid and Medicare.

Real Health Care Reform Alternative

Portability and Individual Control

National private insurance pool to foster competition and choice

Ala cart add-ons and Catastrophic Only Coverage options

Legal reform (tort reform) to limit awarded damages

Medical claims and records accessible to all providers

Health savings accounts for every individual/family

Tax credits for businesses and individual for Health Savings Account (HSA) funding

Evidence based protocol high quality care

Mandatory generic medication

Biosimilar specialty drug medication pathway

Conversion of Medicare to this private path for those age 30 and under

Conversion of Medicaid to this private path with government subsidies in HSA

Conversion of VA from federal control to this private HSA/national pool system

No lifetime or annual caps

High risk policies for pre-existing conditions

The main premise behind this new system is to shift the responsibility and choice to the individual rather than the government or business. With this maximum flexibility, legal reform, and wiring the system you can reduce overall health care cost while providing high quality care. This also is in alignment with conservative ideals of preserving freedom for the patient, provider, and insurance companies.

The starting point is to provide each individual a HSA which can only be used for medical expenditures. All funds deposited in the account would be tax free to whoever put the funds into the account (individual, business, and/or government). This is an incentive for employers to provided health care coverage by depositing money into the employees HSA and be able to deduct that from their taxes. Likewise, individuals and small businesses would benefit the same. All money in the HSA can be rolled over to the following year. You do not have to use it or lose it. In addition, for those employees less than 30 years of age their Medicare payroll taxes would be deposited into the HSA. That portion would not be able to be used until 65 years of age. At which time you use those funds to purchase your medical insurance instead of relying on the Medicare government run system. One other benefit I would expect to see is for those individuals that choose not to buy an insurance policy they could use the funds in this account to pay for their medical expenditures out of pocket.

Secondly, a national pool of all insurance policy choices would be developed. Similar to ACA, but this is national and not state by state pool. State pools inherently limits choice since not all states are equal. I would like to see all insurance companies compete against each other and no matter where you live you have the same choices as everyone else. By applying competition among private insurance companies and those companies competing for millions more customers, it will keep insurance premiums down as compared to pre and post ACA. Since the infrastructure from the ACA is in place you can leverage this but eliminate the state choices and have one national pool of all choices. Finally, you would not limit the choices to four plans, but whatever options the insurance companies want to offer with additional ala cart coverages.

Third, the national insurance pool would contain catastrophic only coverage options in addition to more full coverage choices. These policies would be ideal for the young and healthy. The premiums for these types of policies would be very affordable since they are designed for high cost unforeseen circumstances. The problem with the ACA is that it treats everyone equal and mandates covered services that a person may never need (ie. maternity care, birth control....). This just increases premiums. By providing many choices for the patients it allows those young and/or healthy individuals to have coverage for big ticket health expenditures and use their HSA to pay for maintenance items.

Tort reform is essential. First, if a provider follows evidence based high quality care protocols and something still goes wrong, no award could be sought. If the provider did not follow current protocols, then the patient could seek a judgment with a cap/limit. The theory behind this is that you should see overall health care savings via two methods. First, if the provider is paying less in malpractice premiums, then they can reduce the cost of their services. Secondly, since the providers do not have to practice defensively, they will not order unnecessary tests and treatments. In reality, there have been studies to try to determine the overall savings. The jury is still out. In some more recent studies the conclusion is that you could see a reduction of health insurance premiums from 1 - 2% by placing caps on non-economic damages (Ronen Avraham, Leemore S. Dafny, and Max M. Schanzenbach, "The Impact of Tort Reform on Employer-Sponsored Health Insurance Premiums", Working Paper No. w15371 (Cambridge, Mass.: National Bureau of Economic Research, September 2009). Finally, according to Law Suit Reform Watch they note that the Agency for Health Care Quality and Reform noted states that capped awards saw an overall health care cost reduction of 3-4%. In the end, this debate will be settled but until then, it does not impact quality of care and does provide incentives to providers to follow evidence based protocols of care.

In my opinion, the most critical piece of cost savings is the implementation of electronic medical records and the ability of providers to access and revise them. It has been estimated to cost approximately $83B in 1992 for the excessive administrative cost (Why Health Care Costs Too Much (cato.org)). In addition, in a study published in JAMA (A preliminary look at duplicate testing associated with lack of electronic health record interoperability for transferred patients (nih.gov)) duplicate testing was found in 32% of the cases examined and 20% had at least one duplicate test that was not clinically indicated. So you can see, if the provider had access to the patients medical records no matter where they were located, they could see past tests, results, and clinical notes to help them determine the best approach for their patient. In the end, this would drastically reduce health care expenditures estimated to approach $513B (inpatient and outpatient savings over 15 years) if EMR was implemented (Can Electronic Medical Record Systems Transform Health Care? Potential Health Benefits, Savings, And Costs | Health Affairs). Further proof of this concept is the pharmacy model. Pharmacies have access to your prescription claims history no matter where you go to fill your prescription. This allows pharmacies to monitor you clinically. This prevents unnecessary duplicate therapies and drug interactions. It is time to apply this model to the medical information.

In conclusion, if you implement the reforms I have listed above, you will drastically cut cost out of our health care system while maintaining and possibly improving patient care. You empower the individual to choose the coverage that meets their needs and is not dependent on the job they perform. It provides an incentive for the individual and employers to deposit funds into the individuals HSA since it is tax deductible. It moves people from a government run model to an individual model where they use the funds in their HSA to buy a policy and pay for their health care services. It fosters competition among health care insurance companies. For those low income individuals that truly need assistance, the government will subsidize their HSA with the appropriate funds to provide them a health policy from the national pool. This eliminates the state led Medicaid programs.

I would expect to see a decrease in fraud, waste, and abuse since private insurance companies manage this far more efficient than the government. I would expect to see high quality health care with lower insurance premiums. The amount of individuals retaining a policy would increase since coverage is affordable. It provides flexibility for an individual to choose what is most appropriate for their life and family. Finally, you should expect the government deficit and debt to decrease since overall spending on health care and administrative functions are lower. It seems to me this is a win-win-win-win for patients, providers, insurance companies, and government. A true partnership without the regulatory constraints and access for all. Lets work on making this happen.

Make each day count!

Beach Bum Philosopher

Comments